When you buy a pill, a medical device, or even a simple bandage, you assume it’s safe. You don’t think about who made it, where, or how many times it was inspected. But behind that assumption is a global system under strain. Foreign manufacturing-especially in pharmaceuticals-is no longer just about saving money. It’s becoming a serious safety risk.

Why Quality Fails Overseas

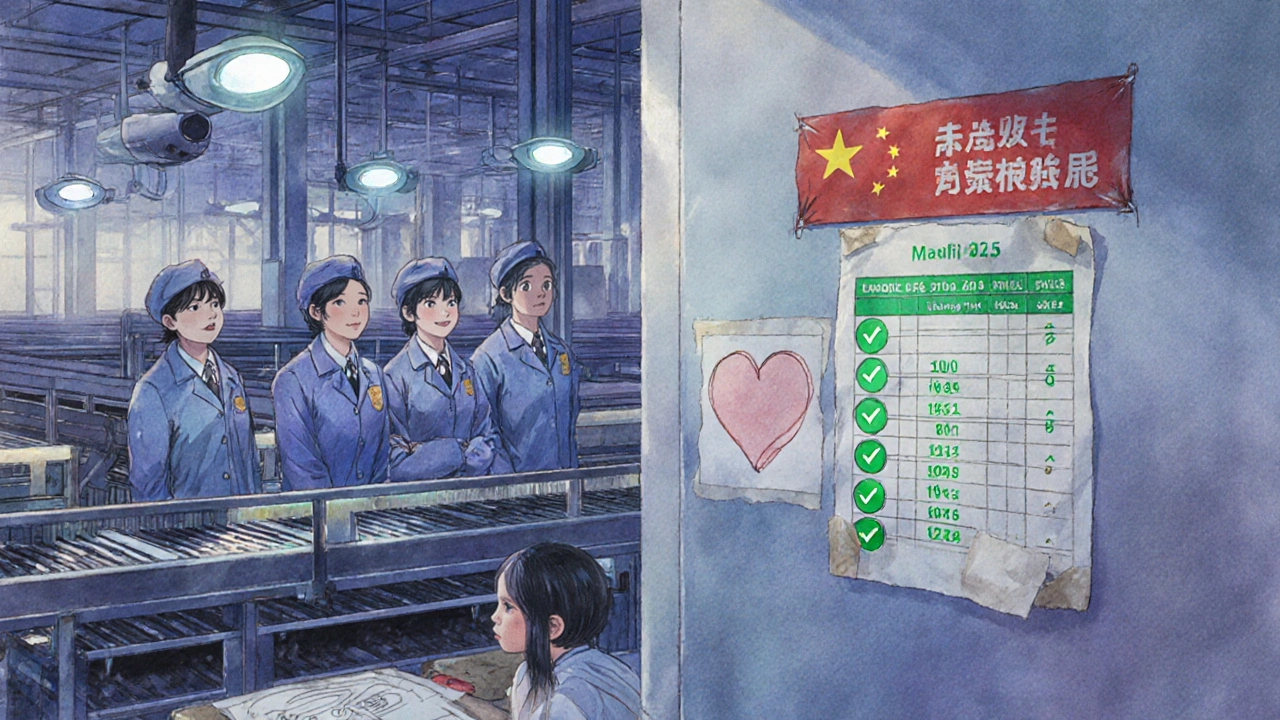

The problem isn’t that overseas factories are inherently bad. It’s that the systems meant to catch mistakes are outdated, inconsistent, and often manipulated. In 2024, the FDA found that 47% of Chinese drug manufacturing sites received formal warnings for quality violations. Compare that to 29% in the U.S. and 33% in Europe. That’s not a coincidence. It’s a pattern. One major reason? Announced inspections. In China, 78% of FDA inspections in 2024 were scheduled in advance. Factories had time to clean up, hide problems, or even stage fake documentation. In the U.S., only 5% of inspections are announced. That’s the difference between a surprise check and a rehearsed show. Then there’s material substitution. A Brookings Institution analysis found that 68% of inspected Chinese facilities replaced approved materials with cheaper alternatives. One case involved a Shenzhen supplier swapping medical-grade silicone for industrial-grade plastic in breathing devices. Twelve thousand units were recalled after failing biocompatibility tests. No one noticed until patients started getting rashes and infections. Falsified records are another red flag. Nearly 30% of non-compliant factories were caught lying about test results. They’d forge batch logs, alter temperature logs, or delete data from monitoring systems. It’s not incompetence-it’s calculated fraud.The Hidden Cost of Cheap Production

Companies think they’re saving 30-45% on labor by moving production overseas. But that’s only the sticker price. The real cost comes later. Harris Sliwoski’s 2025 report shows unaddressed quality failures add 15-25% to total manufacturing costs. That’s from recalls, legal fees, lost sales, and damaged brand trust. One German company lost $1.2 million after a Chinese supplier shipped substandard components-and then sued them through Sinosure, China’s state-backed export credit agency. The German firm had no legal protection. In the U.S., 37% of drug shortages in 2024 were tied to foreign manufacturing quality issues. The FDA doesn’t just shut down factories-it halts entire supply chains. When a single batch of a generic blood pressure drug fails, thousands of patients go without. That’s not a supply chain glitch. It’s a public health crisis.Where the Problems Are Worst

China dominates global manufacturing, holding 31.6% of the market in 2025. But its quality landscape is splitting in two. On one side: high-tech factories compliant with “Made in China 2025.” These firms use AI-driven inspection systems, real-time sensors, and blockchain traceability. They’re investing in training, automation, and compliance. On the other side: hundreds of smaller, financially stressed suppliers cutting corners. These are the ones failing inspections. They’re the ones replacing materials. They’re the ones falsifying records. And they’re still shipping to global brands because they’re cheap and easy to find. India is another hotspot. Despite making up only 25% of foreign drug facilities, Indian manufacturers accounted for 34% of FDA import alerts in 2024. The issue isn’t labor-it’s weak quality assurance teams. In many cases, the person responsible for signing off on quality has no real authority. They’re told what to approve, not allowed to question it. Vietnam, meanwhile, is improving. Since 2022, quality metrics there have risen 18%. Why? Better training, clearer contracts, and more foreign oversight. It’s proof that quality can improve-but only if you actively demand it.What’s Being Done-And What’s Not

The FDA is finally catching up. In May 2025, Commissioner Marty Makary announced a major shift: unannounced inspections. By the end of 2025, 40% of foreign inspections will be surprise visits. By 2027, that number will jump to 75%. That’s a game-changer. The EU already has a better system. Their Qualified Person (QP) rule requires every batch of medicine to be certified by a licensed professional based in the EU. That person signs their name-and takes legal responsibility. If the batch is bad, they’re on the hook. No hiding behind a factory manager. No outsourcing blame. This system has cut quality failures by 22% in EU-manufactured drugs. Experts like Dr. Jessica Rose from White & Case argue the U.S. should adopt a similar model: a U.S.-based certified professional who must personally approve every imported batch. No signature, no shipment. Meanwhile, AI is stepping in. GQC.io’s 2025 survey found AI-powered visual inspection systems catch 99.2% of defects-far better than human inspectors at 85-90%. But here’s the catch: only 22% of Chinese manufacturers have fully integrated these systems. Most still rely on people with clipboards and flashlights.

How to Protect Yourself

If you’re sourcing products overseas, here’s what actually works:- Don’t trust paper certifications. ISO 9001 means nothing if no one enforces it. Demand video audits and real-time production feeds.

- Send your own quality manager. Not a third-party auditor. Someone you trust, on-site, full-time. One Minnesota medical device company reduced defects from 12.7% to 0.8% by placing their own QA lead in China.

- Use blockchain traceability. Every component, every batch, every test result recorded on an immutable ledger. No editing. No deleting.

- Require unannounced audits. Your contract must give you the right to show up anytime-with no notice. If the supplier refuses, walk away.

- Test every shipment. Don’t rely on the factory’s test reports. Send samples to an independent lab. Even if it costs more, it’s cheaper than a recall.

The Future Is Either Safer-or Worse

The choice isn’t between domestic and overseas manufacturing. It’s between smart oversight and blind trust. Companies that treat quality as a checklist are going to get burned. The FDA’s new inspection rules, combined with stricter penalties and better tech, mean the days of getting away with cutting corners are ending. But for every company that adapts, there’s another that still believes “it won’t happen to me.” That mindset is dangerous. In 2025, a single bad batch from an overseas factory can shut down a global brand. It can cost lives. It can trigger lawsuits that bankrupt a small business. The solution isn’t to stop making things overseas. It’s to stop pretending quality is automatic. You have to build it in. You have to monitor it constantly. You have to hold people accountable. Otherwise, the next time you open a pill bottle, you might not be holding medicine.Why are inspections in China often announced in advance?

Many foreign regulators, including the FDA, historically scheduled inspections in advance to coordinate logistics, avoid diplomatic tensions, and work around limited staffing. This gave factories time to clean up, hide violations, or prepare fake documentation. As of 2025, the FDA is shifting to unannounced inspections to close this loophole, aiming for 75% of foreign inspections to be surprise visits by 2027.

Can AI really fix quality problems in overseas factories?

Yes-but only if implemented properly. AI-powered visual inspection systems detect 99.2% of defects, far outperforming human inspectors. However, only 22% of Chinese manufacturers have fully adopted these systems as of Q2 2025. Many still rely on manual checks. AI works best when combined with real-time sensors, blockchain traceability, and trained staff who can respond to alerts.

Is it safer to manufacture in the U.S. than overseas?

Generally, yes. U.S. facilities face stricter, unannounced inspections, stronger legal accountability, and more consistent enforcement. In 2024, only 29% of U.S. drug manufacturing sites received FDA warning letters, compared to 47% in China. But U.S. production is significantly more expensive. The trade-off is cost versus control.

What’s the biggest mistake companies make when sourcing overseas?

Relying on third-party auditors or supplier-provided certificates. Many of these reports are misleading or fabricated. The most successful companies place their own quality control staff on-site, conduct unannounced visits, and test every shipment independently. Trust, but verify-with data, not promises.

How can small businesses protect themselves from overseas quality failures?

Start small. Test one batch before committing to large orders. Use independent labs for every shipment. Demand clear, written quality metrics in your contract-not vague promises. Invest $18,500 per year per facility in training and verification. And never sign a contract without the right to unannounced audits. The upfront cost saves you from a recall, lawsuit, or lost reputation.

Are there any success stories in overseas manufacturing?

Yes. A Minnesota medical device company reduced defects from 12.7% to 0.8% between 2023 and 2025 by implementing a "China-specific quality triad": a full-time local quality manager, blockchain traceability for every component, and third-party lab verification of every batch. It cost more upfront-but eliminated recalls and built long-term trust with customers.

What’s the "Made in China 2025" initiative, and does it help quality?

Launched in 2015, Made in China 2025 is a government plan to upgrade China’s manufacturing to high-tech standards. It pushes automation, AI, and quality control in large factories. Some top-tier manufacturers have improved dramatically. But the initiative doesn’t cover small suppliers, who still dominate the export market. As a result, quality is becoming more polarized: excellent in some factories, dangerously poor in others.

Is "friend-shoring" a better alternative to manufacturing in China?

Moving production to allied countries like Vietnam, India, or Mexico can reduce political risk-but it doesn’t automatically mean better quality. Many of these countries lack strong regulatory infrastructure. Companies that shift without building proper oversight systems often repeat the same mistakes. Success depends on how you manage quality-not where you make it.

Sean Hwang

November 14, 2025 AT 20:22Man, I just got a new blood pressure med last week and never even thought about where it came from. Guess I’m one of those people who assumes it’s safe. Scary stuff.

Barry Sanders

November 16, 2025 AT 04:4547% of Chinese factories get warning letters? Wow. And we still buy from them because it’s cheap. Classic. We’re literally gambling with people’s lives.

Chris Ashley

November 17, 2025 AT 01:22Bro, I work in med supply. I’ve seen the docs. Some of these factories? They’re just warehouses with a stamp that says ‘quality checked.’ No one’s checking shit. Just sign here, move on.

kshitij pandey

November 17, 2025 AT 08:21As someone from India, I see this daily. It’s not about the country-it’s about the company. I’ve worked with factories here that are spotless, and others where the QA guy is just a clerk with no power. We need systems, not stereotypes.

Brittany C

November 18, 2025 AT 18:37The EU’s Qualified Person model is actually a regulatory masterstroke. Holding an individual legally accountable for batch certification creates intrinsic compliance incentives. It’s not just about oversight-it’s about liability internalization.

Sean Evans

November 19, 2025 AT 02:48😂😂😂 Oh my god, we’re still letting China make our pills? And we wonder why people are dying? 🤦♂️ The FDA’s late to the party. They should’ve shut this down 10 years ago. Wake up, America.

Anjan Patel

November 20, 2025 AT 16:52This is the result of capitalism run amok. Companies don’t care about safety-they care about margins. And we, the consumers, are the ones paying the price. It’s not a system failure-it’s a moral failure.

Scarlett Walker

November 22, 2025 AT 08:55I read this and thought about my grandma’s insulin. She’s 82 and takes it every day. If something went wrong with her meds? I don’t even want to think about it. We need to do better. Not just for profits-for people.

Hrudananda Rath

November 23, 2025 AT 11:10It is, indeed, an incontrovertible fact that the global pharmaceutical supply chain has been rendered perilously fragile by the systemic abdication of regulatory diligence. The commodification of human health, in the pursuit of fiscal efficiency, constitutes not merely negligence-but an ethical catastrophe of epochal proportions.